Jump to:

.

Derivatives

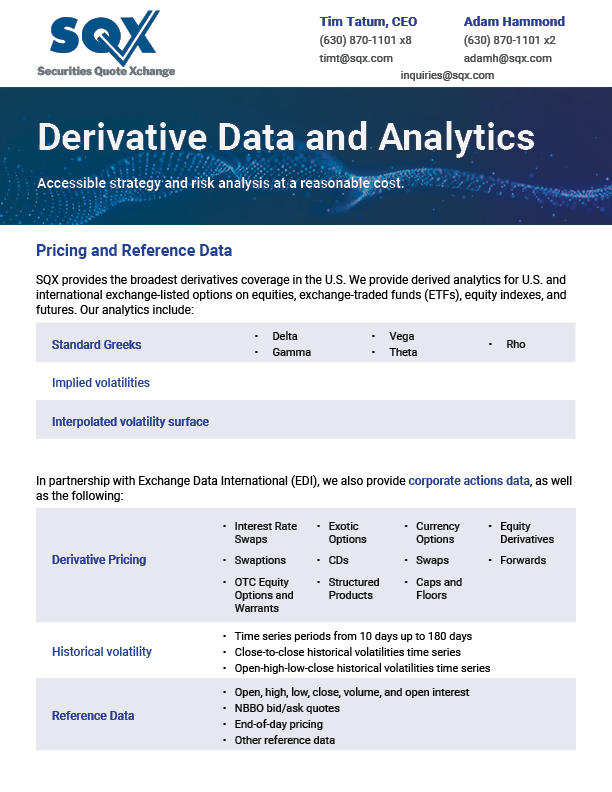

SQX provides the largest coverage in the U.S. for derivatives. We deliver derived analytics for U.S. and international exchange-listed options on equities, exchange-traded funds (ETFs), equity indexes, and futures.

Our coverage includes implied volatilities, interpolated surface, structured products, exotic options, currency options, interest rate swaps, equity derivatives, swaptions, CDs,

forwards, OTC equity options and warrants, as well as caps and floors.

We won’t be your first provider of derivative data and analytics.

But we might just be your best.

.

.

FX Option Volatilities

We deliver FX volatility data that's designed for firms who need reliable, cost-effective insights into global currency and precious metal options. Built on real dealer quotes, our data empowers clients to make informed decisions for pricing, risk, and portfolio analytics. With flexible delivery options and fast, responsive support, SQX delivers world-class quality and service—at a fraction of the cost.

For FX volatility data, the choice is clear.

SQX is your best bet.

.

.

Swaption Volatilities

SQX's swaption volatility data service provides daily model-calibrated volatility surfaces for interest rate swaptions. This product is built from direct dealer quotes and methodically calibrated to ensure accuracy. We provide intraday or end-of-day updates, as well as world-class client support.

Designed for seamless integration into valuation, risk, and analytics workflows, SQX's swaption volatility data is practical and cost-effective—giving you the insight you need without the overhead you don’t.

.

.

Greeks

Together with Exchange Data International (EDI) and Symbol Master Inc, SQX offers worldwide Greeks—perfect for quantitative users who need to understand actual liquidity assumptions and market conditions without assumptions influencing the data. Our coverage includes the standard Greeks (Delta, Gamma, Vega, Theta, Rho), and includes 21 countries—including the United States.

For real market data based on implied volatility,

SQX has got your back.

.

.

Reference Data and Corporate Actions

SQX and Exchange Data International (EDI) have partnered to offer corporate actions and reference data.

Our corporate actions data coverage includes worldwide and US equities, initial public offerings (including North American exchange IPOs), readable corporate action notices, China-listed companies and equities, worldwide dividends (announcements and forecasting), worldwide shares outstanding, universal depository receipts, and US bankruptcy data.

The reference data we offer includes derivatives reference data, securities reference data, municipal bond reference data, US equities historical reference data, and foreign ownership limitations data, alongside document retrieval and global market and public holidays information.

With corporate actions information and reference data from EDI and SQX, you can be confident that you're receiving

the information you need, when you need it.

.