Ahead of the Curve: SQX Q1 2024 Review

2024 is well underway, and SQX has been hard at work! We’re excited to share what SQX has been up to in the past months.

New Product Spotlight: Global Curves

- We are excited to launch global yield curves that offer up-to-date information from around the world. Our zero-coupon curves include interest rates for government bonds from 70 countries.

- SQX coverage includes the full yield curve, from overnight rates to long-term bond yields.

New Product Spotlight: Corporate Curves

- In Q1, SQX officially launched our corporate curves product, offering coverage over a wide range of credit ratings (AAA-CCC).

- Our corporate curves are fully transparent — we share a full list of constituents for each curve.

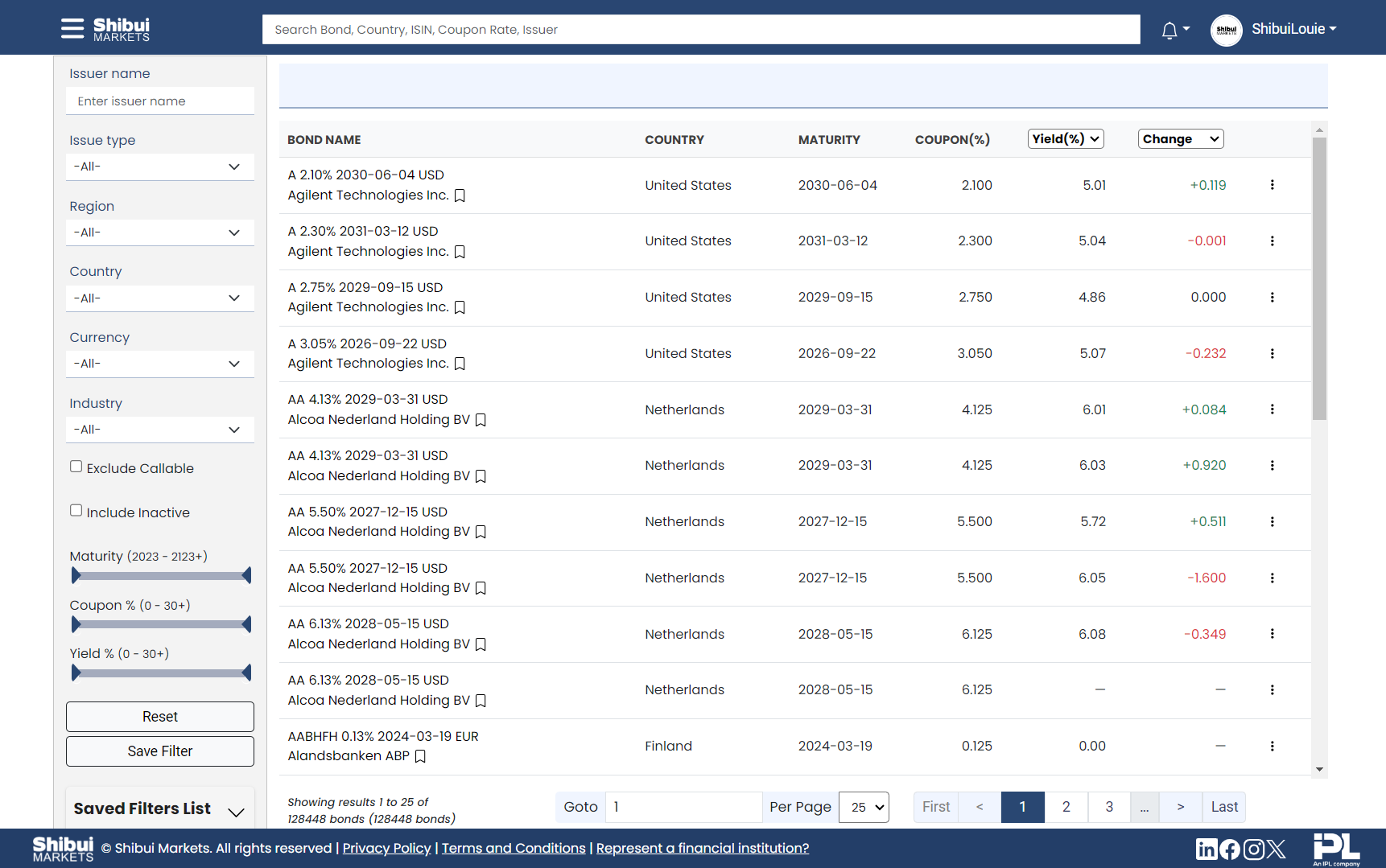

Introducing Shibui Markets

In March 2024, SQX officially launched Shibui Markets — a new web app that offers free fixed-income data for retail investors. Powered by SQX’s high-quality data, Shibui features an open-access database of over 160,000 global corporate bonds and structured notes.

While many retail investors face high access costs or limited availability of critical market data, Shibui provides users with free access to daily pricing updates, market yields, and historical price data on the bonds that interest them. With a free user account, investors can access advanced analytics, create fantasy portfolios, and engage in vibrant discussions, enhancing their investment strategies without any cost.

Shibui Markets represents a transformative shift in retail fixed-income investing, making detailed financial information readily accessible to all.

Note: Shibui Markets is now known as SQX Bonds

Increasing Demand for Best Execution Data

In Q1 2024, SQX noticed an increasing demand for the use of our data for best execution. In the past months, several of our clients have noted the value and effectiveness of our corporate and municipal bond data, and have begun using it for their best-execution practices. In particular, we’ve seen increased use of trade/pre-trade data and evaluated prices for fixed-income best execution.

Expansion of University of Chicago Partnership

In Q1, SQX has been in talks with the University of Chicago to make our muni evaluations available for graduate students. This partnership will involve creating a University of Chicago portal to allow graduate students to access financial market data to support their research projects. The data featured will include SQX municipal bond pricing data — calculated with our proprietary, MSRB-compatible, market-driven approach — as well as the bid/offer stack from our sister company MBIS.

Want more SQX updates? Follow SQX on LinkedIn and subscribe to our

LinkedIn

newsletter to stay ahead of the curve.